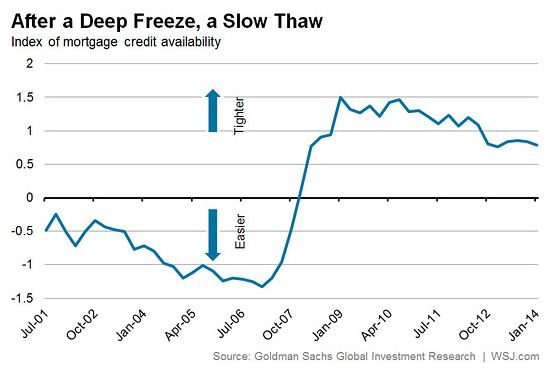

With the market as it is right now, many would-be homeowners are finding out that it's not nearly as easy as it once was to buy a home. Those of us who have clear memories of the 2008 meltdown know this isn't 100% a bad thing, but it's not 100% a good thing, either. Many people who desperately want to own a home and seem like they should easily qualify are being turned down. So--just how hard is it to qualify for a mortgage? Why, and is there an alternative?

What is a qualified mortgage?

The new standard mortgage known as a "qualified mortgage", or "QM" is a result of the Dodd-Frank Act. The portion of the act that controls Qualified Mortgages went into effect on January 10th, 2014. The Dodd-Frank act requires that originators make a good faith effort to verify a borrower's ability to repay their mortgage and imposes stiff penalties if they do not. As the Washington Post puts it, "Basically, a qualified mortgage will be one that a household can reasonably be expected to repay." After the housing bubble and subsequent meltdown, lenders realized their liability in making loans that could never be repaid and are now veering in the opposite direction by increasing restrictions and being extremely cautious. How do they decide what

Why might this be bad?

With the memories of the housing crisis and their legal troubles still crystal clear, lenders are hesitant to take even the tiniest risk on borrowers, which means less people are buying, which in turn means that the market cannot fully recover. Many analysts are saying that the "next phase of the housing recovery depends crucially on mortgage credit availability," as in this article. People unable to buy homes affects the economy in many ways, one of which is its effect on real estate agents and appraisers. With groups such as the self-employed, recent grads with large student loans, retirees, commission-based incomes, and ex-homeowners recovering from the crisis many times excluded from qualifying, the pool of potential buyers has shrunk significantly, and with it, business opportunities for many.

Is there an alternative?

As it happens, private businesses are noticing the opportunities in the gaps left in the market by big lenders, and are hustling to fill those gaps with alternatives. For example, my friend, Casey Jenkins, Mortgage Sales Mgr. at Safe Credit Union Sacramento, told me about the "Safe Alternative Loan", which is a portfolio loan that Safe Credit Union is offering. This alternative loan product allows for more of a judgment call on each individual case and allows the lender to decide if a loan "makes sense" rather than if it meets the (vague) federal requirements of a QM. This allowance for judgment calls on the part of the lender means that requirements are less stringent and the waiting period after a derogatory financial experience is shorter. This is not a loan that will be sold on the secondary market. It does not meet current Fannie Mae requirements as a Fannie Mae requirements for lending to borrowers that went through short sales, Chapter 7, or foreclosure are strict and require passage of four, four, and seven years, respectively. The Safe Alternative Loan requires only two years to pass after any of these financial hardships before considering borrowers for a loan. This is not an ad for the Safe Alternative Loan, just an observation that private businesses are stepping in to fill the gap left by stringent federal requirements. In coming months and years, I believe we will see more lenders offering alternative lending programs and more borrowers taking advantage of such alternatives. When government over regulates to the point that the market begins to be choked out, the market and market participants finds a way to survive. At lease that's what I think!

What do you think? Realtors, have you had any experience with these stringent requirements making it hard for your clients to get loans in the past year or so? Appraisers, how have you seen this in your own field? Let us know in the comments!